What Are Mutual Funds?

Mutual funds are investment instruments that pool money from multiple investors to create a diversified portfolio of securities, including stocks, bonds, money market instruments, gold, silver, and real estate investment trusts (REITs). Each investor holds units representing their share in the mutual fund scheme, which is professionally managed by fund managers according to the investment objectives.

How to Invest in Mutual Funds in India

Mutual fund investments begin with New Fund Offers (NFOs) launched by asset management companies (AMCs). Investors subscribe to units at a set price (usually Rs10 per unit). To invest, you must be KYC-compliant, providing bank details and necessary documents. After the NFO period, funds are allocated across securities based on the scheme's investment strategy. Investors can later buy, redeem, or switch mutual fund units based on prevailing Net Asset Values (NAVs), with equity fund redemptions typically settled within T+3 days.

Types of Mutual Funds

The Securities and Exchange Board of India (SEBI) has classified mutual funds into five broad categories to ensure transparency and simplify investment choices:

Equity-Oriented Funds - Invest primarily in stocks, aiming for long-term capital appreciation. Includes large-cap, mid-cap, small-cap, flexi-cap, sectoral/thematic, ELSS, etc.

Equity-Oriented Funds - Invest primarily in stocks, aiming for long-term capital appreciation. Includes large-cap, mid-cap, small-cap, flexi-cap, sectoral/thematic, ELSS, etc.

Debt-Oriented Funds - Focus on fixed-income securities like bonds and money market instruments. Includes overnight, liquid, short-duration, long-duration, corporate bond, gilt, etc.

Debt-Oriented Funds - Focus on fixed-income securities like bonds and money market instruments. Includes overnight, liquid, short-duration, long-duration, corporate bond, gilt, etc.

Hybrid Funds - Combine equity and debt investments for balanced risk and returns. Includes aggressive hybrid, balanced advantage, equity savings, arbitrage, etc.

Hybrid Funds - Combine equity and debt investments for balanced risk and returns. Includes aggressive hybrid, balanced advantage, equity savings, arbitrage, etc.

Solution-Oriented Funds - Designed for specific financial goals like retirement planning and children's education.

Solution-Oriented Funds - Designed for specific financial goals like retirement planning and children's education.

Other Funds - Includes index funds, ETFs, fund-of-funds (FoFs), and international funds.

Other Funds - Includes index funds, ETFs, fund-of-funds (FoFs), and international funds.

Mutual Fund Taxation in India

Equity Funds (65%+ equity allocation)

Short-term capital gains ( - Taxed at 15%)

Long-term capital gains (>12 months) - Tax-free up to Rs. 100,000, then taxed at 10%

Debt & Non-Equity Funds

Short-term capital gains ( - Taxed at investor's applicable tax rate)

Long-term capital gains (>36 months) - Taxed at 20% with indexation benefits)

Why Invest in Mutual Funds?

Diversification & Professional Management

Diversification & Professional Management

Flexibility Across Investment Goals

Flexibility Across Investment Goals

Tax Benefits & Wealth Growth Opportunities

Tax Benefits & Wealth Growth Opportunities

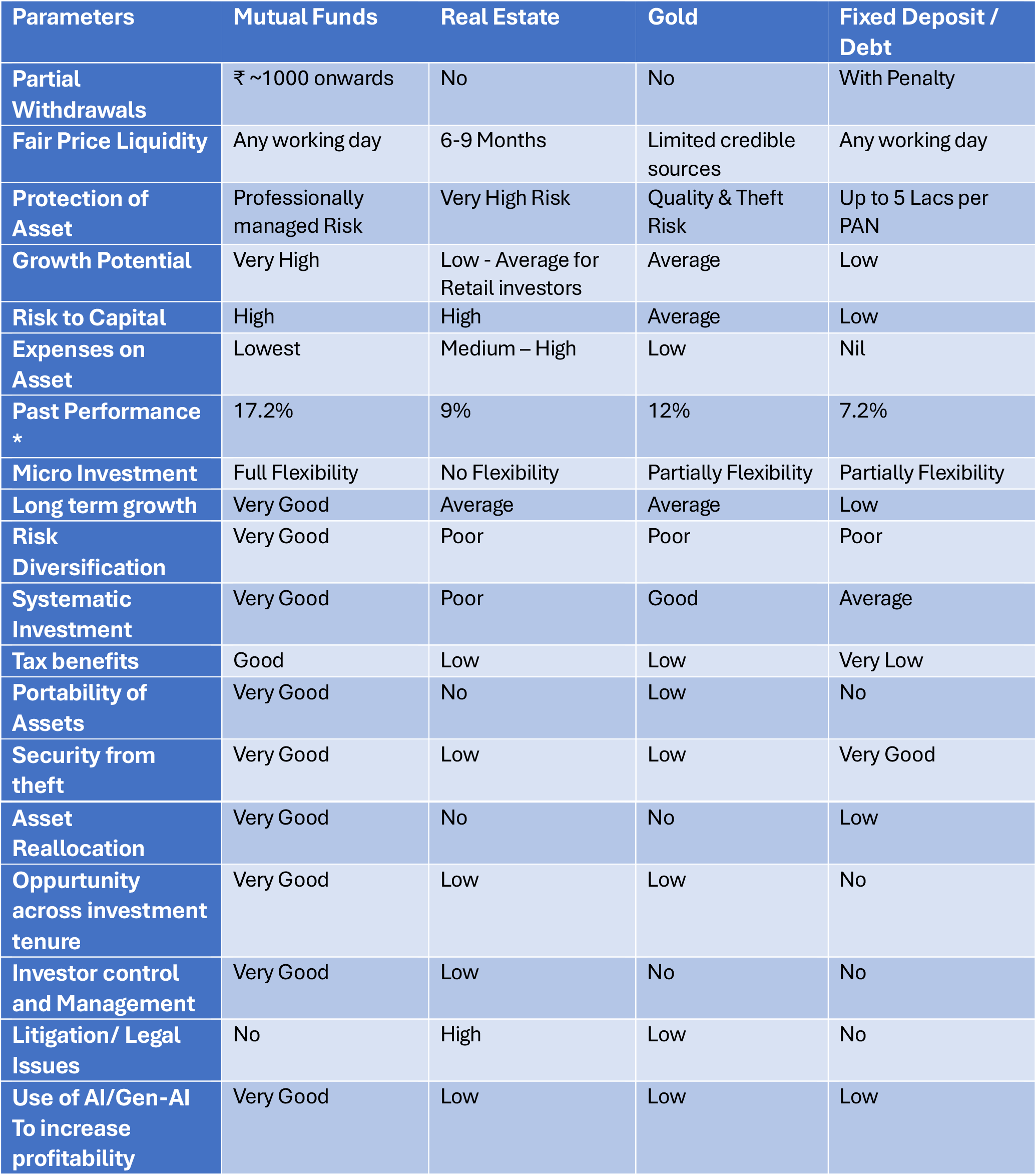

Below is the perspective of Mutual funds we derived from our Analysis compared with similar asset classes like Real estate, Gold, Fixed deposits and Equity trading

Why Mutual Funds?

Source : Funds India Wealth Conversation Report Click Here

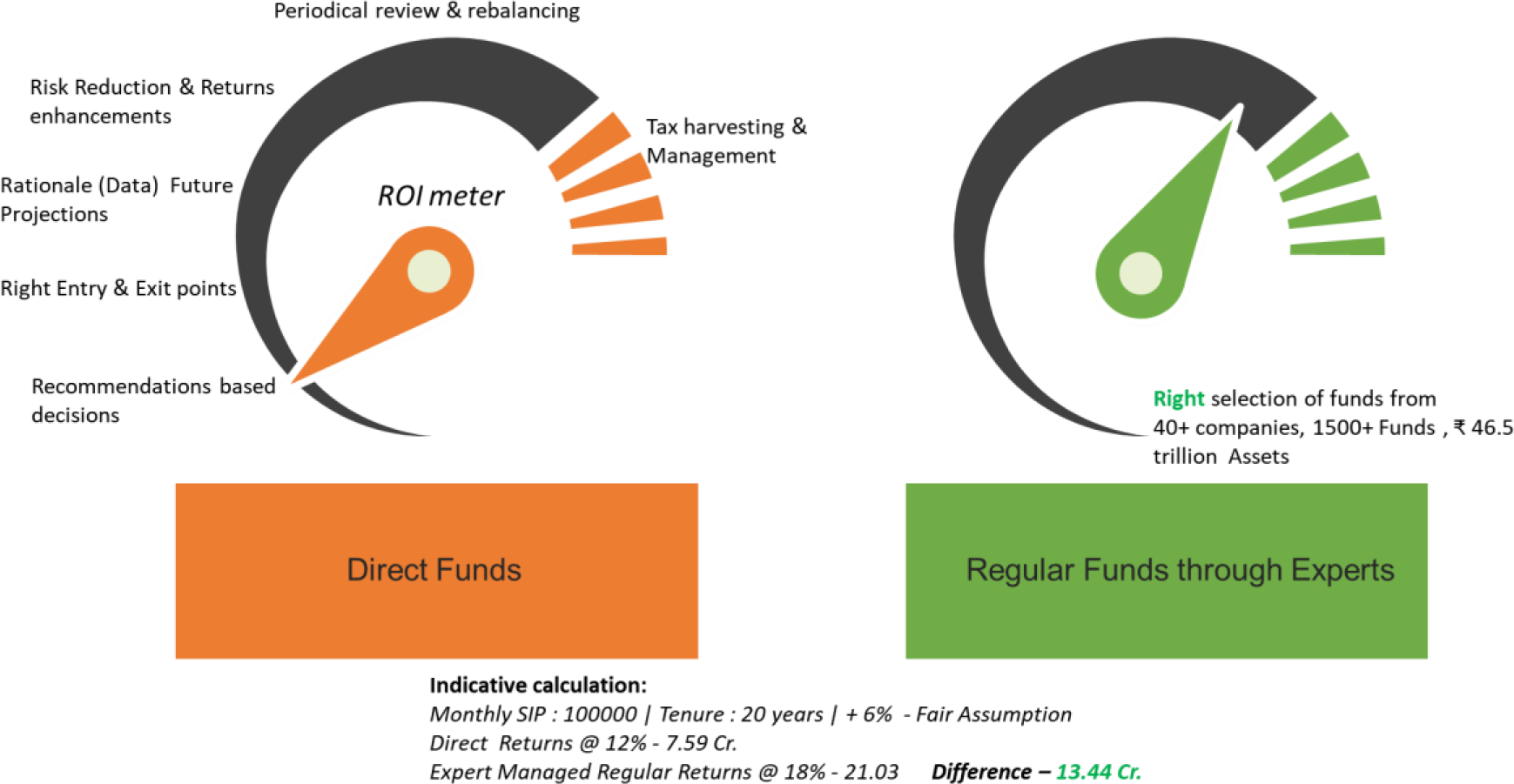

Retail investor Direct investment Vs Expert Managed Regular Funds